Inflation • Federal Reserve System • Stock market • Finance

Inflation • Federal Reserve System • Stock market • Finance

Inflation is an increase in the overall level of prices for goods and services in an economy. It is typically measured as the percentage change in the consumer price index (CPI), which is a basket of commonly-used goods and services. Inflation can have a range of impacts on the economy and on individuals and businesses.

One of the main tools that governments and central banks use to manage inflation is monetary policy. The Federal Reserve System, the central bank of the United States, uses monetary policy to influence the money supply and interest rates in order to maintain stable prices and support economic growth.

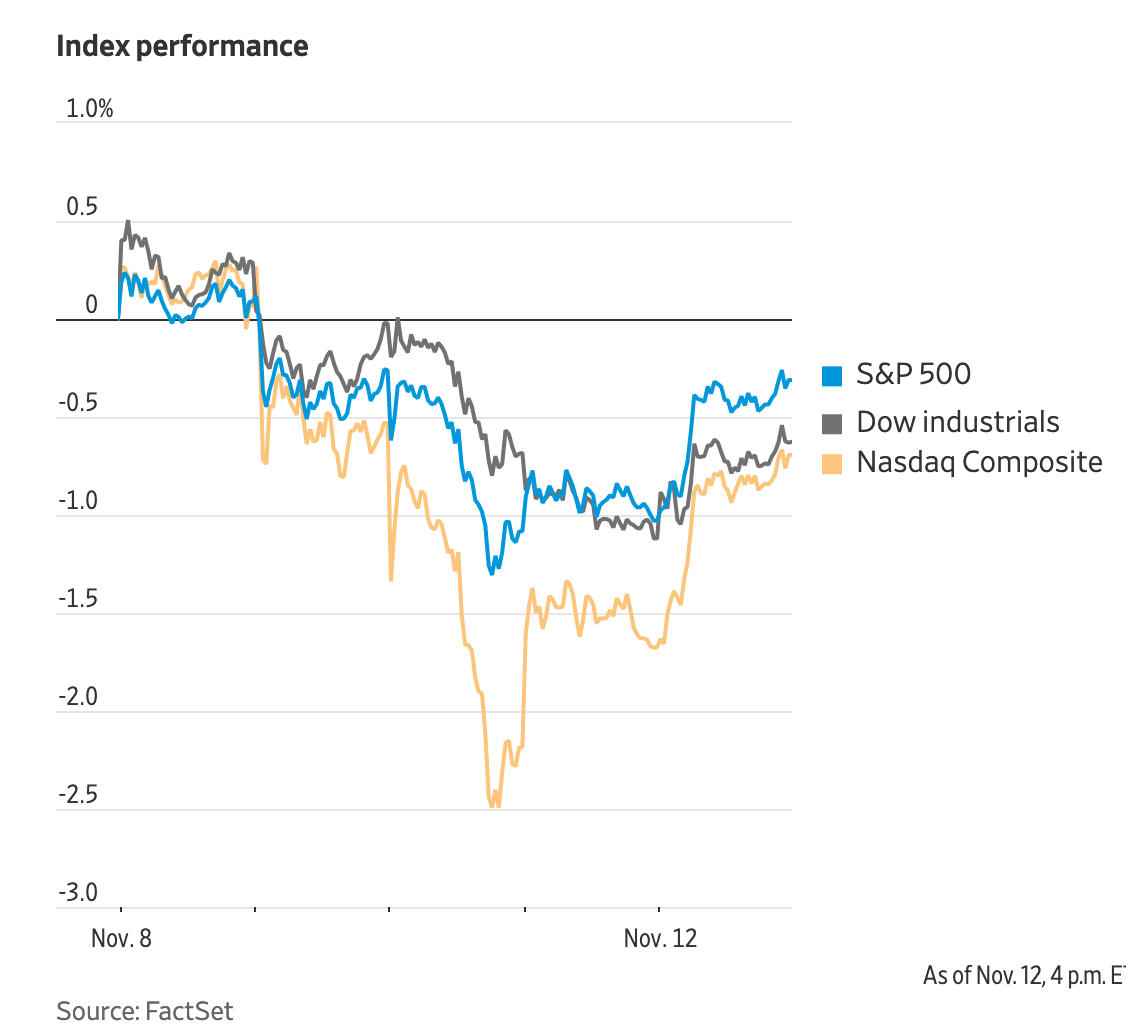

Inflation can have a range of impacts on the stock market. If inflation is low and stable, it can create a favorable environment for businesses and investors, as it indicates that the economy is growing and consumers have purchasing power. However, if inflation is high and volatile, it can create uncertainty and lead to a decline in stock prices.

Inflation can also affect individual investors and businesses. High inflation can erode the purchasing power of individuals, as their money is worth less over time. It can also make it difficult for businesses to plan and budget, as the cost of goods and services may be unpredictable.

Overall, inflation is an important factor in the economy and can have a range of impacts on the stock market and on individuals and businesses. It is closely monitored by governments, central banks, and investors, and is a key factor in the management of the economy.

Comments

Post a Comment

If you have any doubts. Please let me know.